-

×

Ubranko przeciwdeszczowe dla bardzo dużego psa Happet

1 × 74,30 zł

Ubranko przeciwdeszczowe dla bardzo dużego psa Happet

1 × 74,30 zł -

×

Kość naturalna prasowana 12,5cm 30 szt. Happet

1 × 129,92 zł

Kość naturalna prasowana 12,5cm 30 szt. Happet

1 × 129,92 zł -

×

Peleryna dla psa Happet 294B oliwkowa L-60cm

1 × 61,63 zł

Peleryna dla psa Happet 294B oliwkowa L-60cm

1 × 61,63 zł -

×

Obroża podwójna Happet SF24 czarna 2.5cm

1 × 20,91 zł

Obroża podwójna Happet SF24 czarna 2.5cm

1 × 20,91 zł -

×

Granulki mix trójkolorowe 80l

1 × 540,73 zł

Granulki mix trójkolorowe 80l

1 × 540,73 zł -

×

Polar dla psa Happet 301A niebieski XS-25cm

2 × 32,64 zł

Polar dla psa Happet 301A niebieski XS-25cm

2 × 32,64 zł -

×

Miska Happet M136 zawieszana 9,5cm/0,3l

1 × 7,53 zł

Miska Happet M136 zawieszana 9,5cm/0,3l

1 × 7,53 zł -

×

Żwirek do akwarium Happet niebieski 1.5cm 0.5kg

1 × 6,15 zł

Żwirek do akwarium Happet niebieski 1.5cm 0.5kg

1 × 6,15 zł -

×

Klatka GREMI Happet K803 AL S1 różowa

1 × 100,50 zł

Klatka GREMI Happet K803 AL S1 różowa

1 × 100,50 zł -

×

Kurtka dla psa Happet 283A czarna S-40cm

1 × 58,01 zł

Kurtka dla psa Happet 283A czarna S-40cm

1 × 58,01 zł -

×

Kurtka dla psa Happet 285A czarna L-60cm

1 × 87,01 zł

Kurtka dla psa Happet 285A czarna L-60cm

1 × 87,01 zł -

×

Peleryna dla psa Happet 292A czarna S-40cm

1 × 48,94 zł

Peleryna dla psa Happet 292A czarna S-40cm

1 × 48,94 zł -

×

Peleryna dla psa Happet 293B oliwkowa M-50cm

1 × 56,19 zł

Peleryna dla psa Happet 293B oliwkowa M-50cm

1 × 56,19 zł -

×

Kurtka dla psa Happet 284A czarna M-50cm

1 × 72,50 zł

Kurtka dla psa Happet 284A czarna M-50cm

1 × 72,50 zł -

×

Miseczka do terrarium M Happet MU595

1 × 24,81 zł

Miseczka do terrarium M Happet MU595

1 × 24,81 zł -

×

Kaczka na białej pałce Happet GM78 360g

1 × 50,08 zł

Kaczka na białej pałce Happet GM78 360g

1 × 50,08 zł -

×

Kamień napowietrzający Happet K213 kula 3.5 cm

1 × 3,02 zł

Kamień napowietrzający Happet K213 kula 3.5 cm

1 × 3,02 zł -

×

Pompa membranowa ACO-9630 Hailea

1 × 329,15 zł

Pompa membranowa ACO-9630 Hailea

1 × 329,15 zł -

×

Kamień napowietrzający Happet K212 kula 2.5 cm

1 × 2,38 zł

Kamień napowietrzający Happet K212 kula 2.5 cm

1 × 2,38 zł -

×

Pałeczki wybarwiające Happet czerwone 3L

1 × 15,36 zł

Pałeczki wybarwiające Happet czerwone 3L

1 × 15,36 zł -

×

Pompa membranowa ACO-9620 Hailea

2 × 278,98 zł

Pompa membranowa ACO-9620 Hailea

2 × 278,98 zł -

×

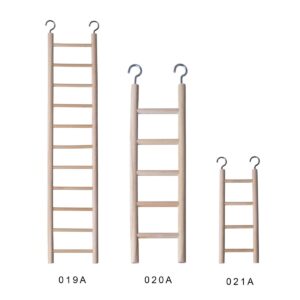

Drabinka dla ptaków 34cm

2 × 9,53 zł

Drabinka dla ptaków 34cm

2 × 9,53 zł -

×

Peleryna dla psa Happet 293A czarna M-50cm

1 × 56,19 zł

Peleryna dla psa Happet 293A czarna M-50cm

1 × 56,19 zł -

×

Kurtka dla psa Happet 284B granat M-50cm

1 × 72,50 zł

Kurtka dla psa Happet 284B granat M-50cm

1 × 72,50 zł -

×

Peleryna dla psa Happet 291A czarna XS-30cm

1 × 43,50 zł

Peleryna dla psa Happet 291A czarna XS-30cm

1 × 43,50 zł -

×

Bekon kurczak & wołowina Happet GM64 500g

2 × 37,50 zł

Bekon kurczak & wołowina Happet GM64 500g

2 × 37,50 zł -

×

Napowietrzacz ACO-2205 Hailea

1 × 89,64 zł

Napowietrzacz ACO-2205 Hailea

1 × 89,64 zł -

×

Zabawka piłka buźka Happet 57mm pomarańczowa

1 × 6,21 zł

Zabawka piłka buźka Happet 57mm pomarańczowa

1 × 6,21 zł -

×

Pałeczki kolor naturalny Happet worek 80l

1 × 194,42 zł

Pałeczki kolor naturalny Happet worek 80l

1 × 194,42 zł -

×

Kamień napowietrzający Happet K215 kula 5 cm

1 × 8,03 zł

Kamień napowietrzający Happet K215 kula 5 cm

1 × 8,03 zł -

×

Klatka GREMI Happet K815 CC M niebieska

1 × 103,08 zł

Klatka GREMI Happet K815 CC M niebieska

1 × 103,08 zł -

×

Obcinacz do pazurów Happet GS21 L

1 × 29,86 zł

Obcinacz do pazurów Happet GS21 L

1 × 29,86 zł -

×

Kamień napowietrzający 15 cm

1 × 28,36 zł

Kamień napowietrzający 15 cm

1 × 28,36 zł -

×

Pałeczki wybarwiające Happet czerwone 10L

1 × 43,01 zł

Pałeczki wybarwiające Happet czerwone 10L

1 × 43,01 zł -

×

Pompa membranowa ACO-9602 Hailea

1 × 94,67 zł

Pompa membranowa ACO-9602 Hailea

1 × 94,67 zł -

×

Kurtka dla psa Happet 352B brąz S-35 cm

1 × 79,74 zł

Kurtka dla psa Happet 352B brąz S-35 cm

1 × 79,74 zł -

×

Polar dla psa Happet 304B fiolet S-40 cm

1 × 41,70 zł

Polar dla psa Happet 304B fiolet S-40 cm

1 × 41,70 zł -

×

Peleryna dla psa Happet 294A czarna L-60cm

1 × 61,63 zł

Peleryna dla psa Happet 294A czarna L-60cm

1 × 61,63 zł -

×

Peleryna dla psa Happet 292B oliwkowa S-40cm

1 × 48,94 zł

Peleryna dla psa Happet 292B oliwkowa S-40cm

1 × 48,94 zł -

×

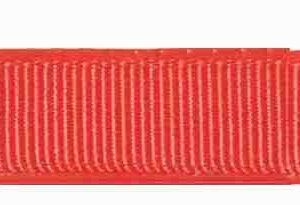

Smycz gładka Happet SE14 czerwona 2.5cm

2 × 12,12 zł

Smycz gładka Happet SE14 czerwona 2.5cm

2 × 12,12 zł -

×

GM06 Dental szczoteczka mint 500g

2 × 89,70 zł

GM06 Dental szczoteczka mint 500g

2 × 89,70 zł -

×

Kurtka dla psa Happet 281A czarna XS-25 cm

1 × 45,31 zł

Kurtka dla psa Happet 281A czarna XS-25 cm

1 × 45,31 zł -

×

Kość wiązana Happet PB14 biała 30cm 3szt.

1 × 49,18 zł

Kość wiązana Happet PB14 biała 30cm 3szt.

1 × 49,18 zł -

×

Granulki mix Happet trójkolorowe 5l

1 × 46,57 zł

Granulki mix Happet trójkolorowe 5l

1 × 46,57 zł

Kwota: 3752,60 zł